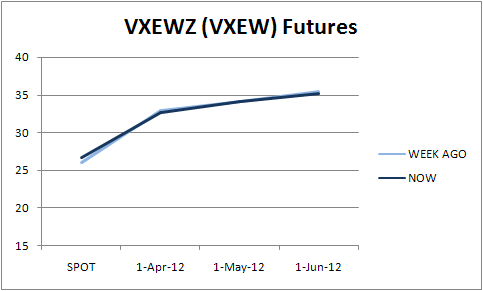

Over the last week volatility indexes remained relatively unchanged. VXEEM traded a healthy 648 contracts, and VXEWZ Futures commenced trading with 100 contracts - 50 in Apr and 50 in May. At the same time CFE/CBOE website removed reference to OVX (OV) Futures. VHSI Futures traded 36 contracts - let's hope the volume will pick up.

Subscribe to:

Post Comments (Atom)

Weekly market report

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

-

John “Hojun” Hwang is the author of VIX, VIX Futures, and VIX ETNs, a conceptual guide to trading the VIX index. He graduated with degrees i...

-

This week 's market movements were largely driven by renewed recession fears in the wake of a sharp rise in office v...

-

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

No comments:

Post a Comment