Recently Deribit, the leading cryptocurrency options exchange introduced a new service - crypto-based USD loans. Here is a blog post that describes existing marketplace for crypto-based loans, and the loan service that they are offering. The service is radically different from existing services, as it relies on hedging.

As described in that blog post I linked above, existing services rely on getting a collateral much higher than the value of the loan, to compensate for the high risk of volatility of crypto. For example, lender may require a 50% loan to value ratio, lending 0.50 per 1.00 of crypto collateral. This is obviously not very efficient use of capital, and still does not protect the lender if value of collateral falls below 50%.

Deribit will be using a combination of over-collateralized lending as above and hedging to provide better rates. For example they may offer 75% loan to value ratio, lending 0.75 for 1.00 of crypto collateral, but hedge their remaining risk by purchasing puts. If the value of collateral declines, the combination of reserve and long put option will protect them from loss.

Why is this important? The answer, in one word would be - SKEW. Crypto lending is a growing market with demand exceeding the supply. If Deribit's lending service will take off, it will create a strong, systematic buying pressure on puts, raising the left skew. I wrote before that markets treat BTC as a speculative asset, with call skew. In a year from now we may see a more symmetric skew behavior in BTC.

Such change may provide an opportunity for an interesting trade - to substitute BTC deltas with a long near ATM call and short OTM put, to capitalize on skew differential.

Bitcoin Volatility, Skew, and Options Pricing, Part 2

The market for BTCUSD options is not a recent phenomenon. There were several "startup" exchanges offering options since shortly after Bitcoin itself rose in popularity. Most them failed in contract design, particularly in their design of handling margining of short option positions, or failing to design decent interface to attract traders, or getting active market makers to provide liquidity. To digress, in my experience most of the cryptocurrency exchanges appear to be designed and operated by web-developers, with no knowledge of how modern financial exchanges work.

Anyway, there is one leading exchange for trading cryptocurrency options - Deribit , and several runner-ups. LedgerX is CFTC registered exchange based in the USA, unfortunately liquidity is at this time is quite low. Their contracts are large, aimed at institutional traders, and trading is somewhat sporadic. Bitmex, a leading futures exchange recently introduced a very poorly designed options contract; liquidity is non-existent. Quedex is another options-focused platform, but I cannot find any volume figures or statistics.

As I mentioned above, only Deribit offers robust liquidity at this time; in the next blog post I will explore bitcoin options pricing and trading strategies.

Anyway, there is one leading exchange for trading cryptocurrency options - Deribit , and several runner-ups. LedgerX is CFTC registered exchange based in the USA, unfortunately liquidity is at this time is quite low. Their contracts are large, aimed at institutional traders, and trading is somewhat sporadic. Bitmex, a leading futures exchange recently introduced a very poorly designed options contract; liquidity is non-existent. Quedex is another options-focused platform, but I cannot find any volume figures or statistics.

As I mentioned above, only Deribit offers robust liquidity at this time; in the next blog post I will explore bitcoin options pricing and trading strategies.

Bitcoin Volatility, Skew, and Options Pricing

As I wrote before, Bitcoin volatility is quite different from volatility of other assets. I will continue with the same topic here.

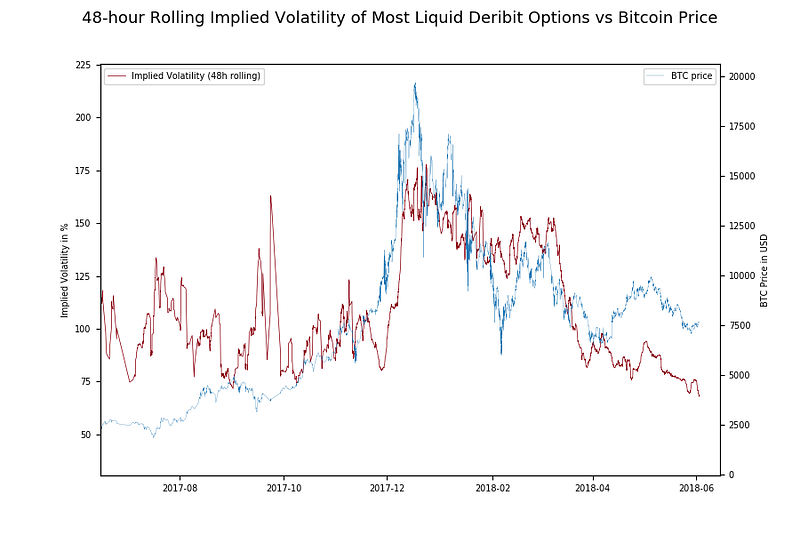

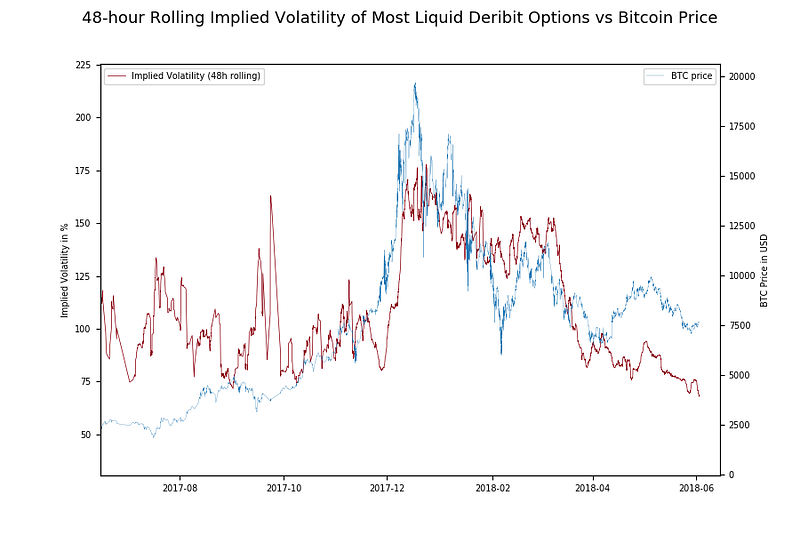

Bitcoin prices shot up to all-time highs this winter, and have sharply declined since. When an equity index declines, volatility typically moves up, but in the case of BTC, volatility has actually declined. This behavior is similar to VIX index. Although I know that mechanism behind this effect is completely different, I want to quote Brian Stutland from about a month ago who said

"Bitcoin is sort of becoming the new VIX, in sort of getting ahead of credit risk in the banking industry,"

"There is huge correlation right now between VIX and bitcoin 30 days ago, 30 trading days ago, that is starting to measure out credit risk in the market. That's what cryptocurrency is becoming. It's becoming a way to sort of de-risk yourself from credit risk in the banking industry."

I think that Mr Stutland's analysis is correct, but only explains a part of BTC movement, as other intrinsic speculative factors certainly dominate.

I calculated median monthly price, and volatility (high accuracy from intraday data), and the correlation indeed looks reasonable on raw prices, but not as well on log scale.

While this analysis is done using realized volatility, blogger Flood did similar analysis using implied volatility derived from options prices on Deribit.

Having established the effect, I believe there is a simpler explanation for positive BTC skew - traders as aggregate think of BTC as a speculative, gambling asset as opposed to investment. When prices are high, and speculators are excited, volatility moves up as well. Now that prices have declined, and speculation frenzy subsided, volatility fell as well.

This is great news for long term investors in BTC, who can purchase either cheap puts as hedge for existing holdings, or cheap calls as speculation.

In the next article I will write about pricing of BTC options, and Deribit exchange.

Bitcoin prices shot up to all-time highs this winter, and have sharply declined since. When an equity index declines, volatility typically moves up, but in the case of BTC, volatility has actually declined. This behavior is similar to VIX index. Although I know that mechanism behind this effect is completely different, I want to quote Brian Stutland from about a month ago who said

"Bitcoin is sort of becoming the new VIX, in sort of getting ahead of credit risk in the banking industry,"

"There is huge correlation right now between VIX and bitcoin 30 days ago, 30 trading days ago, that is starting to measure out credit risk in the market. That's what cryptocurrency is becoming. It's becoming a way to sort of de-risk yourself from credit risk in the banking industry."

I think that Mr Stutland's analysis is correct, but only explains a part of BTC movement, as other intrinsic speculative factors certainly dominate.

I calculated median monthly price, and volatility (high accuracy from intraday data), and the correlation indeed looks reasonable on raw prices, but not as well on log scale.

While this analysis is done using realized volatility, blogger Flood did similar analysis using implied volatility derived from options prices on Deribit.

Having established the effect, I believe there is a simpler explanation for positive BTC skew - traders as aggregate think of BTC as a speculative, gambling asset as opposed to investment. When prices are high, and speculators are excited, volatility moves up as well. Now that prices have declined, and speculation frenzy subsided, volatility fell as well.

This is great news for long term investors in BTC, who can purchase either cheap puts as hedge for existing holdings, or cheap calls as speculation.

In the next article I will write about pricing of BTC options, and Deribit exchange.

Subscribe to:

Comments (Atom)

Weekly market report

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

-

John “Hojun” Hwang is the author of VIX, VIX Futures, and VIX ETNs, a conceptual guide to trading the VIX index. He graduated with degrees i...

-

This week 's market movements were largely driven by renewed recession fears in the wake of a sharp rise in office v...

-

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...