Bitcoin prices shot up to all-time highs this winter, and have sharply declined since. When an equity index declines, volatility typically moves up, but in the case of BTC, volatility has actually declined. This behavior is similar to VIX index. Although I know that mechanism behind this effect is completely different, I want to quote Brian Stutland from about a month ago who said

"Bitcoin is sort of becoming the new VIX, in sort of getting ahead of credit risk in the banking industry,"

"There is huge correlation right now between VIX and bitcoin 30 days ago, 30 trading days ago, that is starting to measure out credit risk in the market. That's what cryptocurrency is becoming. It's becoming a way to sort of de-risk yourself from credit risk in the banking industry."

I think that Mr Stutland's analysis is correct, but only explains a part of BTC movement, as other intrinsic speculative factors certainly dominate.

I calculated median monthly price, and volatility (high accuracy from intraday data), and the correlation indeed looks reasonable on raw prices, but not as well on log scale.

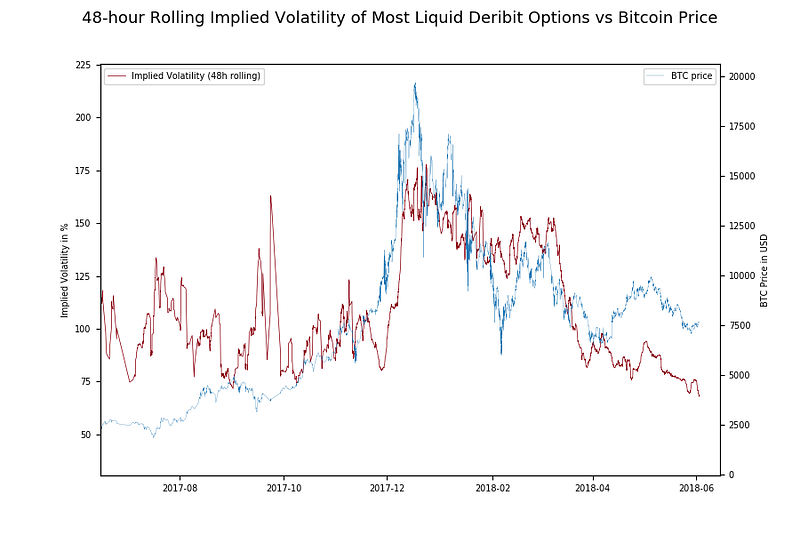

While this analysis is done using realized volatility, blogger Flood did similar analysis using implied volatility derived from options prices on Deribit.

Having established the effect, I believe there is a simpler explanation for positive BTC skew - traders as aggregate think of BTC as a speculative, gambling asset as opposed to investment. When prices are high, and speculators are excited, volatility moves up as well. Now that prices have declined, and speculation frenzy subsided, volatility fell as well.

This is great news for long term investors in BTC, who can purchase either cheap puts as hedge for existing holdings, or cheap calls as speculation.

In the next article I will write about pricing of BTC options, and Deribit exchange.

No comments:

Post a Comment