Recently Deribit, the leading cryptocurrency options exchange introduced a new service - crypto-based USD loans. Here is a blog post that describes existing marketplace for crypto-based loans, and the loan service that they are offering. The service is radically different from existing services, as it relies on hedging.

As described in that blog post I linked above, existing services rely on getting a collateral much higher than the value of the loan, to compensate for the high risk of volatility of crypto. For example, lender may require a 50% loan to value ratio, lending 0.50 per 1.00 of crypto collateral. This is obviously not very efficient use of capital, and still does not protect the lender if value of collateral falls below 50%.

Deribit will be using a combination of over-collateralized lending as above and hedging to provide better rates. For example they may offer 75% loan to value ratio, lending 0.75 for 1.00 of crypto collateral, but hedge their remaining risk by purchasing puts. If the value of collateral declines, the combination of reserve and long put option will protect them from loss.

Why is this important? The answer, in one word would be - SKEW. Crypto lending is a growing market with demand exceeding the supply. If Deribit's lending service will take off, it will create a strong, systematic buying pressure on puts, raising the left skew. I wrote before that markets treat BTC as a speculative asset, with call skew. In a year from now we may see a more symmetric skew behavior in BTC.

Such change may provide an opportunity for an interesting trade - to substitute BTC deltas with a long near ATM call and short OTM put, to capitalize on skew differential.

Bitcoin Volatility, Skew, and Options Pricing, Part 2

The market for BTCUSD options is not a recent phenomenon. There were several "startup" exchanges offering options since shortly after Bitcoin itself rose in popularity. Most them failed in contract design, particularly in their design of handling margining of short option positions, or failing to design decent interface to attract traders, or getting active market makers to provide liquidity. To digress, in my experience most of the cryptocurrency exchanges appear to be designed and operated by web-developers, with no knowledge of how modern financial exchanges work.

Anyway, there is one leading exchange for trading cryptocurrency options - Deribit , and several runner-ups. LedgerX is CFTC registered exchange based in the USA, unfortunately liquidity is at this time is quite low. Their contracts are large, aimed at institutional traders, and trading is somewhat sporadic. Bitmex, a leading futures exchange recently introduced a very poorly designed options contract; liquidity is non-existent. Quedex is another options-focused platform, but I cannot find any volume figures or statistics.

As I mentioned above, only Deribit offers robust liquidity at this time; in the next blog post I will explore bitcoin options pricing and trading strategies.

Anyway, there is one leading exchange for trading cryptocurrency options - Deribit , and several runner-ups. LedgerX is CFTC registered exchange based in the USA, unfortunately liquidity is at this time is quite low. Their contracts are large, aimed at institutional traders, and trading is somewhat sporadic. Bitmex, a leading futures exchange recently introduced a very poorly designed options contract; liquidity is non-existent. Quedex is another options-focused platform, but I cannot find any volume figures or statistics.

As I mentioned above, only Deribit offers robust liquidity at this time; in the next blog post I will explore bitcoin options pricing and trading strategies.

Bitcoin Volatility, Skew, and Options Pricing

As I wrote before, Bitcoin volatility is quite different from volatility of other assets. I will continue with the same topic here.

Bitcoin prices shot up to all-time highs this winter, and have sharply declined since. When an equity index declines, volatility typically moves up, but in the case of BTC, volatility has actually declined. This behavior is similar to VIX index. Although I know that mechanism behind this effect is completely different, I want to quote Brian Stutland from about a month ago who said

"Bitcoin is sort of becoming the new VIX, in sort of getting ahead of credit risk in the banking industry,"

"There is huge correlation right now between VIX and bitcoin 30 days ago, 30 trading days ago, that is starting to measure out credit risk in the market. That's what cryptocurrency is becoming. It's becoming a way to sort of de-risk yourself from credit risk in the banking industry."

I think that Mr Stutland's analysis is correct, but only explains a part of BTC movement, as other intrinsic speculative factors certainly dominate.

I calculated median monthly price, and volatility (high accuracy from intraday data), and the correlation indeed looks reasonable on raw prices, but not as well on log scale.

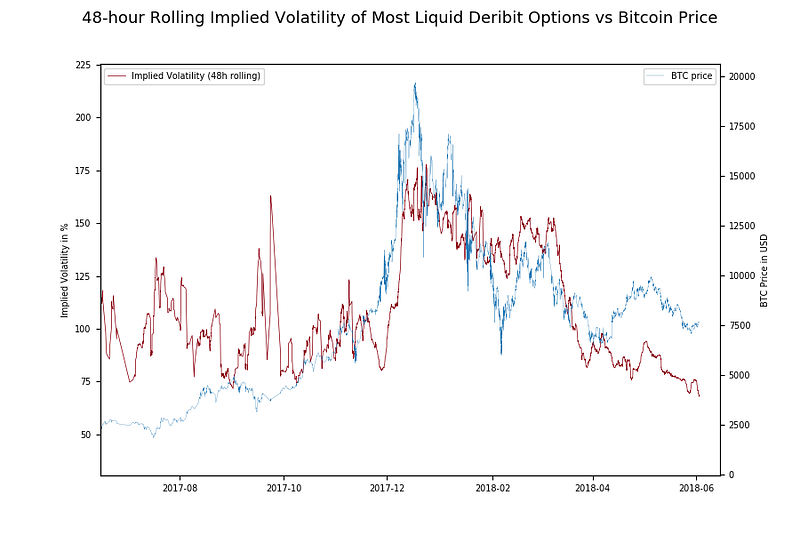

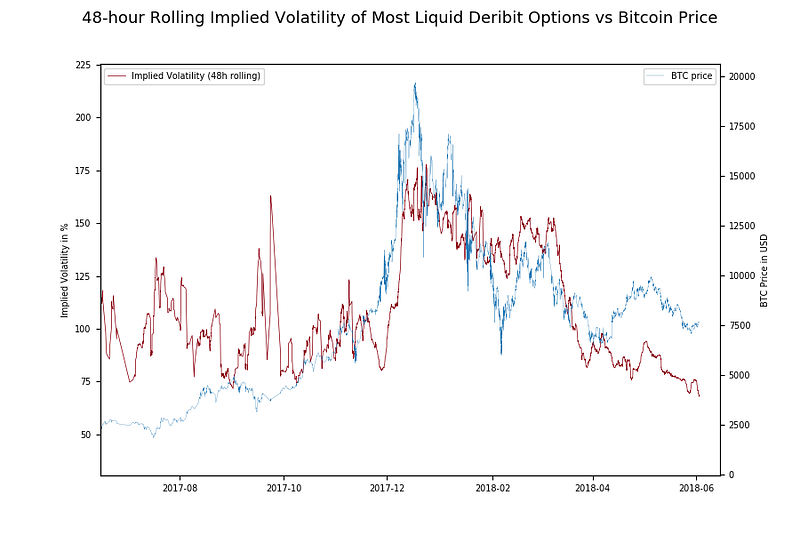

While this analysis is done using realized volatility, blogger Flood did similar analysis using implied volatility derived from options prices on Deribit.

Having established the effect, I believe there is a simpler explanation for positive BTC skew - traders as aggregate think of BTC as a speculative, gambling asset as opposed to investment. When prices are high, and speculators are excited, volatility moves up as well. Now that prices have declined, and speculation frenzy subsided, volatility fell as well.

This is great news for long term investors in BTC, who can purchase either cheap puts as hedge for existing holdings, or cheap calls as speculation.

In the next article I will write about pricing of BTC options, and Deribit exchange.

Bitcoin prices shot up to all-time highs this winter, and have sharply declined since. When an equity index declines, volatility typically moves up, but in the case of BTC, volatility has actually declined. This behavior is similar to VIX index. Although I know that mechanism behind this effect is completely different, I want to quote Brian Stutland from about a month ago who said

"Bitcoin is sort of becoming the new VIX, in sort of getting ahead of credit risk in the banking industry,"

"There is huge correlation right now between VIX and bitcoin 30 days ago, 30 trading days ago, that is starting to measure out credit risk in the market. That's what cryptocurrency is becoming. It's becoming a way to sort of de-risk yourself from credit risk in the banking industry."

I think that Mr Stutland's analysis is correct, but only explains a part of BTC movement, as other intrinsic speculative factors certainly dominate.

I calculated median monthly price, and volatility (high accuracy from intraday data), and the correlation indeed looks reasonable on raw prices, but not as well on log scale.

While this analysis is done using realized volatility, blogger Flood did similar analysis using implied volatility derived from options prices on Deribit.

Having established the effect, I believe there is a simpler explanation for positive BTC skew - traders as aggregate think of BTC as a speculative, gambling asset as opposed to investment. When prices are high, and speculators are excited, volatility moves up as well. Now that prices have declined, and speculation frenzy subsided, volatility fell as well.

This is great news for long term investors in BTC, who can purchase either cheap puts as hedge for existing holdings, or cheap calls as speculation.

In the next article I will write about pricing of BTC options, and Deribit exchange.

Bitcoin Futures, Part 2

It was a tight race between CME and CBOE to be the first one to list BTC futures, but CBOE turned out to be a winner. Bitcoin futures will start trading on CFE platform this Sunday, Dec 10, at 6pm EST.

According to Reuters, CME is scheduled to list futures 8 days later, on December 18th.

The margin information is also available now - but in short futures will offer about 2x leverage. To me this seems quite tame comparing to other bitcoin changes, but roughly in line with what I expected for CBOE or CME.

According to Reuters, CME is scheduled to list futures 8 days later, on December 18th.

The margin information is also available now - but in short futures will offer about 2x leverage. To me this seems quite tame comparing to other bitcoin changes, but roughly in line with what I expected for CBOE or CME.

Bitcoin Futures

While news have been dominated with upcoming launch of CME bitcoin futures, I would like to remind readers that shorting is available on most major bitcoin exchange, and futures are available on major platforms like Bitmex, OKCoin, and Deribit.

In a more recent news, if you want to go with a more established exchange two Swiss banks listed certificates that trade pretty much like futures, on SIX Swiss exchange

I am not familiar with details of the contracts, so cannot offer comparison between them, but there are certainly a lot of options if someone wants to bet against bitcoin.

Bitcoin and Volatility, Part 3

Yesterday Russel Rhoads wrote an article comparing recent VIX and Bitcoin volatility. I am reposing a table that summarizes his findings:

The first chart pictures the term structure of VIX's historical volatility. What we see is that short-term volatility is high, and long-term volatility is low. This makes sense because this is what we actually observe from the time series, they appear to be mean-reverting (we're not saying necessarily that mean-reversion is the driving process), just that positive moves are likely to be followed by more negative moves, and negative moves are likely to be followed by more positive moves, keeping the index in a range.

But even though daily volatility of the two is at about the same level, it is a different type of volatility. While VIX moves quite a lot from day to day, over the long periods of time it stays in a relatively narrow range. Bitcoin on the other hand is volatility over the short term, and over the long term.

To illustrate the difference I will create a plot of term structure of volatility - how historical volatility evolves as a function of interval. So the first point in the plot will be annualized volatility calculated from one day returns, the second point will be from 2 day returns, etc.

The second chart is one for BTC USD rate I downloaded from Coindesk. What we see in the chart is just the opposite - volatility is increasing as function of time interval. Such behavior is common for trending time series, where positive moves are likely to be followed by more positive moves, and negative moves are likely to be followed by more negative moves.

So, if we were to extrapolate the historical behavior of these time series, and extend the charts beyond 100 trading days, we can make the following (and I'm sure quite imprecise) predictions: in a year from now 1 std move in VIX will be 30% ( 9.7-17.7 ), while 1 std move in BTC will be 190% ( 1,200-53,000 )

These forecasts are not serious forecasts, they just illustrate what some of the patterns we observe in the time series imply about future events.

Bitcoin and Volatility, Part 2

Apparently Thomas Peterffy was not swayed by CME Group's Terry Duffy phonecall, and published an open letter to CFTC in today's issue of the Wall Street Journal (also available on IB's website)

In the letter, Mr Peterffy proposes to isolate Bitcoin futures clearing funds from all other deposited funds to prevent financial contagion. I think this risk is something that can be addressed with higher (maybe even 100%) margin requirement for bitcoin futures, but it is more important to understand why one of the top leaders of derivatives trading is not buying this argument.

The letter presents several arguments, which I will quote in a different order than they appear in the letter.

I completely agree with the statement, and daily (or whatever the time interval) trading pauses just buy time, and do not prevent clearing firms from going bust. However in this respect XBT futures are no different from other products - trading halts mitigate risk, they don't eliminate it. So I don't agree with this argument.

This is no different from other products as well - the seller of ESZ7 contract also faces the same, potentially unlimited risk, if S&P 500 index goes to 20000. And yet, you can as easily short futures as buy them. So I disagree with the second argument as well.

I would argue that one person's fundamental basis is another person's bs, and people disagree about fundamental valuations of different products all the time. In fact the very reason why markets exist is because people disagree on valuation. And just like other futures products, XBT futures "may assume any price from one day to the next." Do stocks have fundamental basis? In 2017 the stock of Polarityte, Inc. ticker symbol COOL, rose about as much as bitcoin. Disagree with the third argument.

This is a "we don't know enough about bitcoin to understand the risks" argument, since 10 years ago we did not have any cryptocurrencies at all. However there is a regulated market, or at least as regulated as FX spot market. Also bitcoin market is a tested market - there are numerous exchanges offering spot, futures, and even options trading. The leverage offered is typically 2x or even 3x, although I think it is too generous.

Even the point that market is not mature is not quite right with me. How long does it take for a market to mature? How would we know? Bitcoin is few months away from it's 9th birthday, and in 2022 we will celebrate bitcoin bar mitzva and declare it a mature market?

We will have to wait and see how this all will play out, but this is certainly very exciting to have a completely different asset class to be listed on a major exchange.

In the letter, Mr Peterffy proposes to isolate Bitcoin futures clearing funds from all other deposited funds to prevent financial contagion. I think this risk is something that can be addressed with higher (maybe even 100%) margin requirement for bitcoin futures, but it is more important to understand why one of the top leaders of derivatives trading is not buying this argument.

The letter presents several arguments, which I will quote in a different order than they appear in the letter.

1 - "Instituting daily price move limits on cryptocurrency derivatives does not solve the problem. In a runaway upward market for example (like the silver market in the 1980’s caused by the Hunt brothers), the futures price gets locked limit-up day after day with little or no trading and the short sellers are unable to cover, leading them (and potentially their clearing firms) to ruin."

I completely agree with the statement, and daily (or whatever the time interval) trading pauses just buy time, and do not prevent clearing firms from going bust. However in this respect XBT futures are no different from other products - trading halts mitigate risk, they don't eliminate it. So I don't agree with this argument.

2 - "Margining such a product in a reasonable manner is impossible. While the buyer (the long side) of a cryptocurrency futures contract or call option could be required to put up 100% of the value to ensure safety, determining the margin requirement for the seller (the short side) is impossible. "

This is no different from other products as well - the seller of ESZ7 contract also faces the same, potentially unlimited risk, if S&P 500 index goes to 20000. And yet, you can as easily short futures as buy them. So I disagree with the second argument as well.

3 - "There is no fundamental basis for valuation of Bitcoin and other cryptocurrencies, and they may assume any price from one day to the next. This has been illustrated quite clearly in 2017 as the price of Bitcoin has increased by nearly 1000%. "

I would argue that one person's fundamental basis is another person's bs, and people disagree about fundamental valuations of different products all the time. In fact the very reason why markets exist is because people disagree on valuation. And just like other futures products, XBT futures "may assume any price from one day to the next." Do stocks have fundamental basis? In 2017 the stock of Polarityte, Inc. ticker symbol COOL, rose about as much as bitcoin. Disagree with the third argument.

4 - "Cryptocurrencies do not have a mature, regulated and tested underlying market. The products and their markets have existed for fewer than 10 years and bear little if any relationship to any economic circumstance or reality in the real world. "

This is a "we don't know enough about bitcoin to understand the risks" argument, since 10 years ago we did not have any cryptocurrencies at all. However there is a regulated market, or at least as regulated as FX spot market. Also bitcoin market is a tested market - there are numerous exchanges offering spot, futures, and even options trading. The leverage offered is typically 2x or even 3x, although I think it is too generous.

Even the point that market is not mature is not quite right with me. How long does it take for a market to mature? How would we know? Bitcoin is few months away from it's 9th birthday, and in 2022 we will celebrate bitcoin bar mitzva and declare it a mature market?

We will have to wait and see how this all will play out, but this is certainly very exciting to have a completely different asset class to be listed on a major exchange.

Subscribe to:

Posts (Atom)

Weekly market report

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

-

John “Hojun” Hwang is the author of VIX, VIX Futures, and VIX ETNs, a conceptual guide to trading the VIX index. He graduated with degrees i...

-

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

-

This week 's market movements were largely driven by renewed recession fears in the wake of a sharp rise in office v...