Anybody who’s been even remotely following the markets over the last month knows that we are living through exceptionally volatile times.

- VIX has reached an all time peak of 83, surpassing the 2008 highs

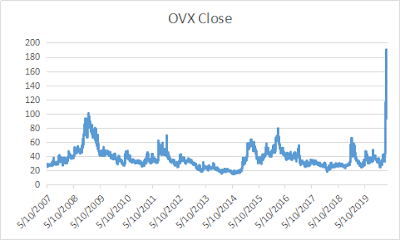

- Crude Oil VIX (OVX) has exceeded high of 220 vol ( 190 record close )

- VIX term structure went on a record inversion

- VXX has went up almost 400% in less than a month

and so on...

With this, a simple spread trade on VXX / VXZ made over 50% in the last month ( and at one point much higher )

And this extreme volatility is not about to subside - with virus still rapidly spreading and posing tremendous health hazards, peak unemployment claims announced just this morning, and increased risk of unhealthy inflation from QE Infinity, volatility is here to stay.

So how should we trade now that the "big move" has already happened? The risk / reward calculus is no longer obvious. Veteran VIX traders who have been through 2008 may have contrarian views, and consider the current regime to yield plenty more opportunities for great trades.

If you remember, in 2014 I interviewed John Hwang (ex head of VIX trading at MS) about how to trade the VIX during market crashes. Recently, I had a chance to speak to John again, and he’s confided that he’s out of retirement, trading up to 17 hours a day, and “arbing the heck” out of the curve.

So I begged him to share some of his favorite trade ideas, and how to navigate the VIX at these levels, after the vol spike… and suggested that he republish his classic book.

Well, republishing books takes a while and because trading opportunities can go away, John has agreed not only to talk about VIX again, but to do a live training webinar to discuss unique, once in a life time opportunities to capitalize in this high VIX regime both on short and long vol sides (yes, even at this level)!

The 2 hr webinar will happen this Sunday (March 29th) at 4 PM Eastern, with an exclusive Q&A session (seats limited), and I will be joining as well. If you are interested, check out this link to find out more.

Subscribe to:

Comments (Atom)

Weekly market report

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

-

John “Hojun” Hwang is the author of VIX, VIX Futures, and VIX ETNs, a conceptual guide to trading the VIX index. He graduated with degrees i...

-

Wall st delivered a mixed bag of news with VIX, VNKY, and VSTOXX and their underlying markets almost unchanged. VXD - volatility index based...

-

This week 's market movements were largely driven by renewed recession fears in the wake of a sharp rise in office v...